America Already Has a Progressive Tax System

Tax Policy – America Already Has a Progressive Tax System

Policymakers at the federal level have expressed interest in raising the tax burden on high-income individuals. For instance, Representative Alexandria Ocasio-Cortez (D-NY) recently proposed raising the top marginal income tax rate to 70 percent.

What these debates sometime gloss over is that the U.S. federal tax system is already progressive. Under current law, high-income taxpayers pay a larger share of the tax burden, while lower- and middle-income individuals shoulder a relatively smaller tax burden. This is true both for federal income taxes and the federal tax code overall. Furthermore, such a high-rate, narrow-base proposal is unlikely to generate a large amount of revenue.

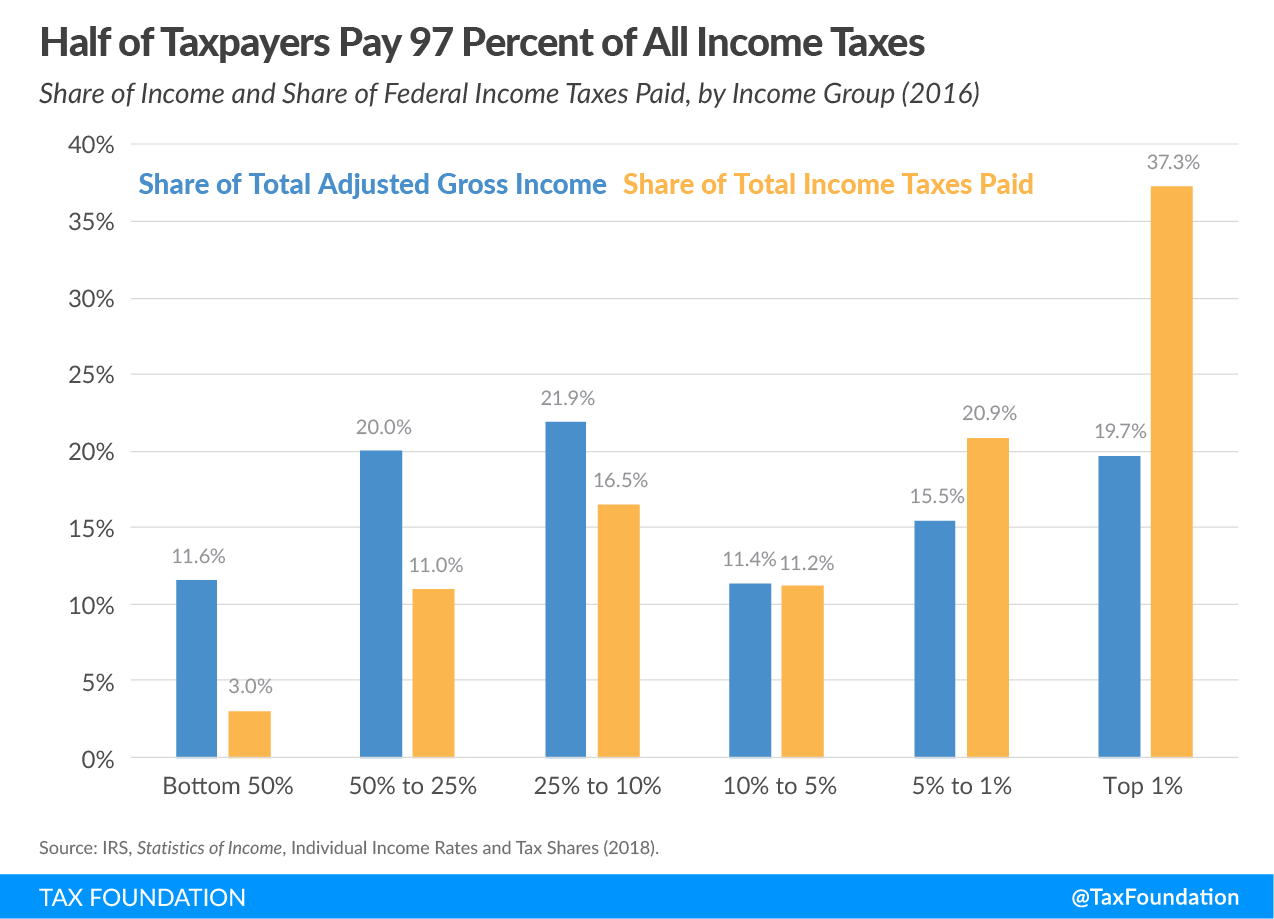

The chart below illustrates how progressive the income tax system is today, as well as which income groups generate the most revenue. In 2016, the bottom 50 percent of taxpayers—those with adjusted gross incomes (AGI) below $40,078—earned 11.6 percent of total AGI. However, this group of taxpayers paid just 3 percent of all income taxes in 2016.

In contrast, the top 1 percent of all taxpayers (taxpayers with AGI of $480,804 and above), earned 19.7 percent of all AGI in 2016, and paid 37.3 percent of all federal income taxes. The top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined, who paid 30.5 percent of all income taxes.

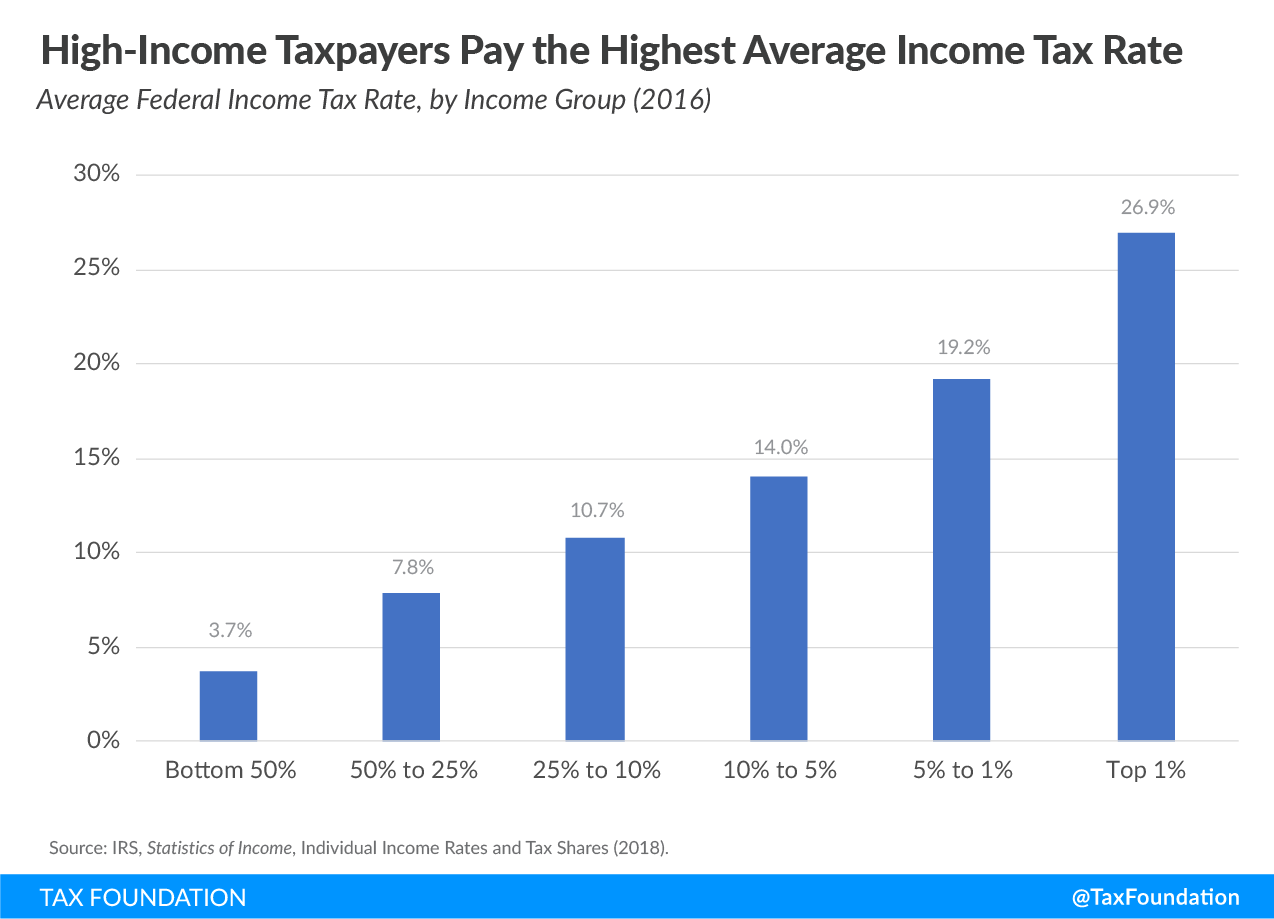

Additionally, as household income increases, average income tax rates rise. For example, the bottom 50 percent of taxpayers (taxpayers with AGIs below $40,078) faced an average income tax rate of 3.7 percent, while taxpayers with AGIs between the 10th and 5th percentiles ($139,713 and $197,651) paid an average rate of 14 percent. The top 1 percent of taxpayers (AGI of $480,804 and above) paid 26.9 percent, more than seven times the rate faced by the bottom 50 percent of taxpayers.

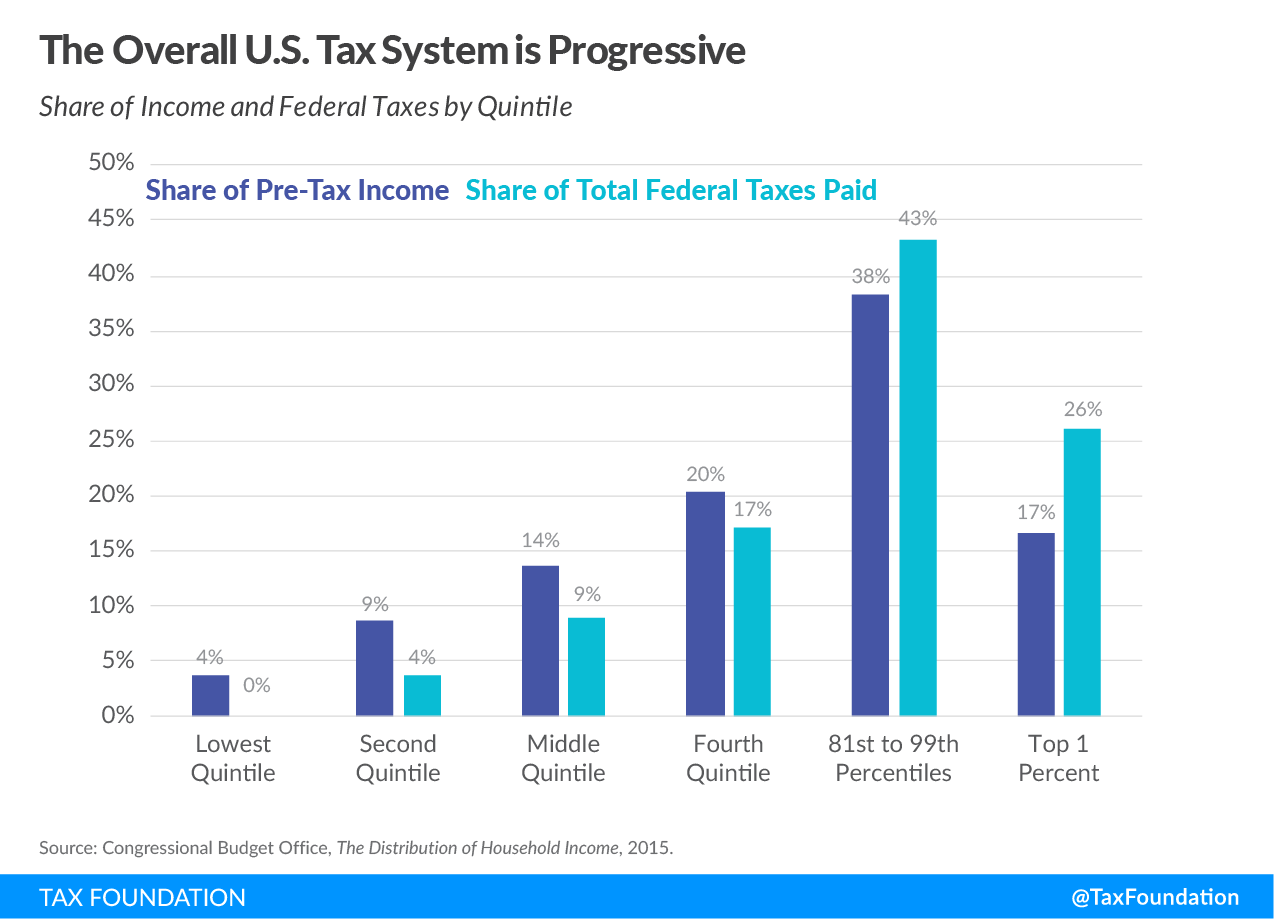

If the tax system weren’t progressive, each income group would bear a more similar share of the total tax burden equal to its share of the nation’s income. However, as the chart below (based on a recent study by the Congressional Budget Office) shows, when we account for all federal taxes—including excise and payroll taxes that tend to be more regressive—high-income taxpayers still bear a disproportionate share of the total burden.

Households in the lowest quintile earned 4 percent of the nation’s income in 2015, while they paid less than 0.5 percent of all federal taxes. Households in the third quintile earned 14 percent of national income and shouldered 9 percent of all federal taxes. Even upper-middle class, consisting of households in the fourth quintile, bore a lower tax burden than their share of national income.

The top 20 percent of households, in contrast, paid 43 cents of every $1 of federal taxes of all kinds, such as individual income, payroll, excises, and corporate income. As with the income tax, this share was greater than their share of the nation’s income, or 38 percent. The top 1 percent of households paid 26 percent of all federal taxes, more than their 17 percent share of the nation’s income.

Any fruitful tax reform discussion must acknowledge of how our tax code works, and which groups pay most. Legislators should keep in mind the tradeoffs involved with trying to raise revenue from a small number of taxpayers, and the challenge of raising substantial revenue without broad-based taxes on all Americans. As these charts show, the present distribution of the tax burden is quite different from what many might think.

Source: Tax Policy – America Already Has a Progressive Tax System